Unlock Expert Advice with Zero Commitment.

We’ve Eliminated the Barriers.

If you are someone who keeps up with Cryptocurrency world then you’d already know about IEO, but in case you don’t, here is a brief rundown for you.

IEO, or Initial Exchange Offering, is a new and fresh method of Cryptocurrency crowdfunding. In it’s basic, it is a new method of cryptocurrency crowdfunding. IEO enables the investor to enter the crypto world with a safe way of investing in projects.

It functions much like ICO, only in case of initial exchange offering, the cryptocurrency exchange platform backs the entire campaign. In this case, the crypto exchanges administer the entire fundraising process.

Unlike ICO, where anyone with a crypto asset can invest in the project, in IEO, the investors need to register with the crypto exchange that is backing the IEO.

Let’s look into the workings of IEO and how we can assist you with IEO development in depth.

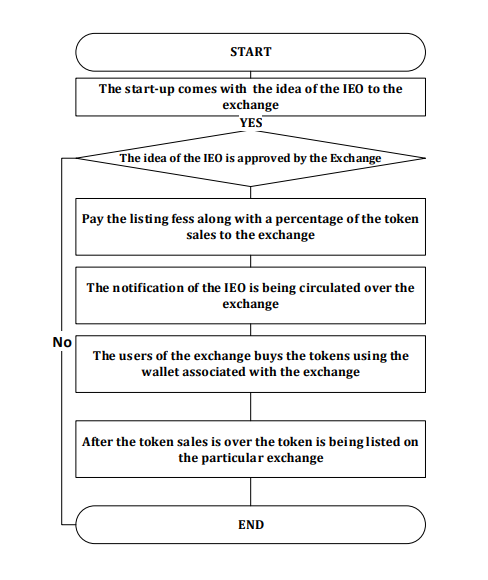

Here is a brief description of how an Initial Exchange offering works-

Before launching the campaign, the crypto exchange that is backing the IEO is going to look into the startup that wants to launch a new currency through the exchange. The exchange analyzes the project in-depth.

Once the project is deemed authentic and valuable, the startup can move onto the next step, that is paying the exchange a listing fee and a percentage of the coins they want to sell through IEO. Since the exchange collects a small percentage of the tokens sold by the issuer, they help the startup with the marketing operations.

Once you pay the fees, the token sale starts on the crypto platform. In case of an IEO, it is only the ones who register with the crypto exchange platform who can start investing in this new token.

The need for another method of crypto crowdfunding was felt when the previous method of crowdfunding, ICO or Initial Coin Exchange went to bust because of rampant fraud. After the long wait, in 2017, the concept of IEO came into being when Binance Exchange helped Gifto and Bread raise $3 million and 6$ million respectively.

But in 2018, Binance issued a statement that said “There is a fundamental problem with IEOs, though. Namely, a high percentage of coins are held by a small number of people.” for the rest of the year, Binance put the concept on hold, until February 2019, when BitTorrent and Fetch.AI raised over $6 million each through IEO campaigns.

According to data from ICO bench so far 35 IEO’s are complete and 10 are underway. However, there is still a little knowledge about how to start an IEO campaign and how to participate in one. So let’s see how to go about it.

Initial Exchange Offering is a remarkable improvement over Initial Coin Offering. So it is obvious that IEO development definitely has some serious benefits. But what are these benefits? Let’s check them out.

The entire process of IEO has some really amazing benefits for the investors. These are-

For the investor, participating in IEO takes minimum effort on their part. It is almost like buying a cryptocurrency on the exchange. All the investor needs to do is to create an account on the exchange platform, go through the KYC process and they are ready to start investing in IEO.

Additionally, the investor doesn’t have to perform a thorough check on the startup, study the various conditions for investing in a project and learn how to buy startup tokens. They can start investing in IEOs very easily with minimal effort.

The obvious benefit for the investor when it comes to an IEO is the security it provides. The investors could not always verify the authenticity of the project. The lack of transparency in the process made it a heaven for the scammers to raise money from the investors who knew next to nothing about the company and its projects.

But to hold an IEO, the startup needs to go through a due diligence process to get listed on the exchange process. This weeds out the frauds, giving the investors a safe environment to invest in.

Compared to ICO, the IEO benefits to the project team in many ways. Whether you are building a blockchain wallet or a P2P payment app, this process can provide startups with benefits like legitimizing the token sales to increasing reputation, the major benefits are-

The project doesn’t have to put in too much effort in the matters of setting up its own KYC/AML process, because they would be using an exchange platform to hold their IEO.

Through initial exchange offering, the startups would get direct access to the large user base of the crypto exchange platform. This way they can reach more people, increasing their chances of raising the amount of fund they need.

With the help of the crypto exchange, the project would have direct access to teams that are experienced in matters of smart contracts, listing, marketing, etc.

Being verified by an exchange platform to be listed on their site makes the startup company seem authentic and credible.

This definitely increases their chances of raising the funds and gain the trust of the investors.

The process holds some serious advantages for the exchange as well. These benefits are-

The due diligence process that every exchange performs on the startups wanting to be listed on the exchange platform raises the bar to enter the crypto exchange market. This way the exchange would ensure that only the credible projects go through and get featured on their site.

The direct listing of new projects gives the exchanges an increased chance of attracting new clients. This means an influx of capital that only translates into the generation of more revenue.

Now that we have talked about what IEO is and what you need for IEO development for your own Blockchain startup, let’s take a look at ICO and what it is.

So, if you are convinced enough about IEO, let’s talk about how you can launch a successful IEO campaign.

Step 1: Choose your crowdfunding option

Step 2: Choose the right cryptocurrency exchange to hold your IEO campaign

Step 3: Negotiating and preparations- technical, marketing and legal aspects

Step 4: Token Minting

Step 5: After IEO- secondary trading and market making.

Knowing about IEO and launching an IEO campaign are two different things. So let’s see how you can launch an IEO campaign for your own startup.

Here are the steps of creating an IEO campaign for your startup.

Before you jump onto the IEO blockchain bandwagon with your brand new startup idea, consider other options.

Not because there are any problems with IEO like ICO, but because IEO is not suitable for all kinds of projects. This specific fundraising method is especially beneficial for the blockchain developers who already have a functioning business with serious turnover. There are two major reasons for it-

Whether you are a big business or a brand new startup, if you have already decided on IEO for your crowdfunding, then let’s talk about the next step.

Once you have decided on IEO, it’s time for you to choose the crypto exchange.

Choosing the exchange is an important step because it is going to administer the entire IEO process for you. The choice of exchange is going to affect your fundraising so consider these factors before choosing an exchange platform-

All these factors make it seem like it is really hard to choose an exchange for an IEO campaign but it really isn’t. These factors only make sure that the quality of the projects is high.

The are many IEO platforms including Binance, Huobi, OKEx, which are more popular than the rest.

Once you have gone through all the factors and picked a proper exchange for your IEO campaign, you have to move onto the next step.

Once you have decided on a crypto exchange platform to hold your IEO campaign, it’s time for negotiating and preparing for technical, marketing and legal aspect of it all.

There are going to be some serious costs to list your app listed on any exchange. This cost depends on the different exchange launchpads. So make sure to clarify the matters of the listing fee before going any farther.

There is also the marketing fee, which the token issuer and the exchange share. Along with that, there is a legal fee as well. All these fees are the main reason why IEO is more suited for a business that already has an annual turn over.

Once the token issuer has jumped through all the hoops and got verified for listing on the crypto exchange launchpad, it’s time for them to mint tokens. Token Minting is an important step for IEO development.

While minting tokens, you have to keep two things in mind.

First, they have to decide on a hard cap for the funding. This goal needs to be practical and tangible. Having an unrealistic goal is only going to make it hard for the token issuer to reach that goal.

Second, the number of tokens to be minted and their price needs to be fixed according to the hard cap fixed by the company.

After you have passed the selection criteria and have minted your token, it can be listed on the platform. This, however, is not the last step for launching an IEO campaign. There is one last step after this.

After a successful launching of the IEO campaign, you now have to take care of two different things-

Now that we have talked about how to launch an IEO campaign, it’s time to find out the real benefits of IEO.

Developing an IEO is not an easy job. It takes a lot of time and a lot of effort. But with our team of highly skilled and experienced blockchain and cryptocurrency developer team, you can rest assured that your IEO exchange is going to be a success.

Our experienced token development team can create tokens for your IEO exchange on a various blockchain platform. Including but not limited to- Ethereum, Steller or EOS. and the best thing, we develop these tokens based entirely on your requirements.

Exchange listing is an integral part of Initial Exchange Offering, and we recognize that fact. Which is why we will help you to create partnerships with the top crypto exchange in the world like

This way we make sure that your IEO campaign proceeds smoothly.

In any blockchain project, a white paper is an essential piece of the document giving a detailed overview of the entire project to the investors. Our team of skilled blockchain developers can make sure that the white paper we write for your project covers each and every aspect of your project.

It might be a little complicated to describe your project to the investors in a simple way, even with a white paper. And that is where our team can help you. We can summarize your project and write a light paper that is simple yet detailed and builds trust among the investors.

For any project, the pitch is important to convince the investors that investment would be beneficial for them. And in the same exact way, your IEO project also needs a project pitch. We can help you create a pitch for your project that will not only contain all the important details of your project but it will also present it in such a way that investors would be compelled to invest in your project.

Crypto wallets are the best way of storing cryptocurrency and performing transactions with it. Which is why we have a dedicated team of blockchain developers who can build a multi-currency crypto-wallet service that will be compatible with your tokens as well.

To ensure that your IEO campaign goes smoothly, especially during the listing phase, we employ a dedicated DevOps team. Our versatile team includes highly skilled and experienced members who can bridge the gap between development and IT relations.

The famous digital protocols, a.k.a smart contracts, are used on blockchain to validate the conditions of legal contract. Our in house team of smart contract developers can help you leverage the ease and convenience of smart contracts on your blockchain platform.

Every IEO project needs a landing page, and that is why our team of developers work hard to create an informative and attractive landing page, that will increase the investor’s belief in your project. We realize that a design-centric approach is not enough, which is why we also optimize the page to make it more effective for your campaign.

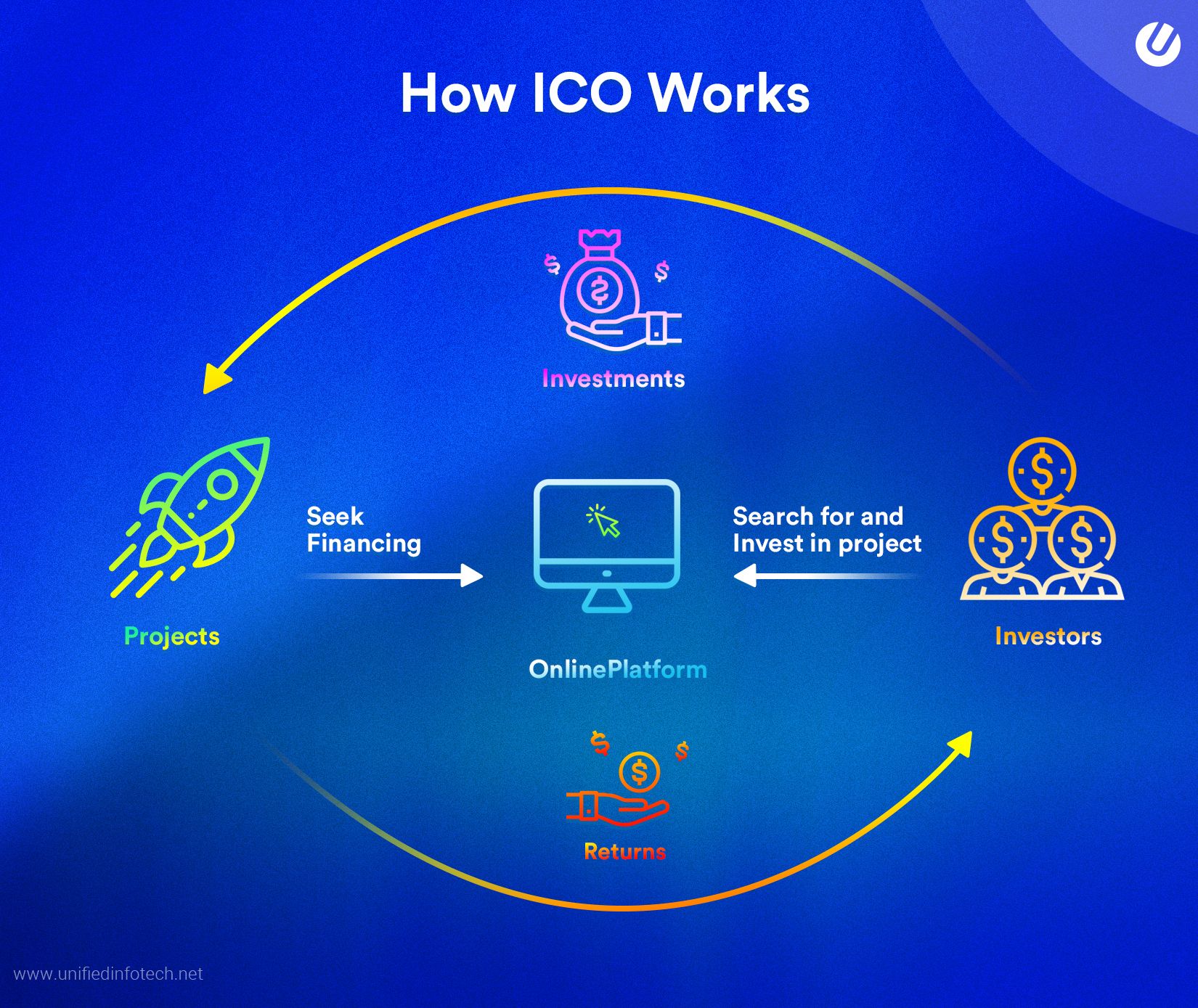

The workings of ICO is pretty simple.

In terms of cryptocurrency crowdfunding, ICO enables people from anywhere in the world with an internet connection and some cryptocurrency asset to invest in a project.

When a startup company wants to raise funds for their new project through ICO, they would usually create a whitepaper. It contains a plan including all the important details of the project, such as what kind of problems can the project solve, how much money requires for the completion of the project, how long the ICO campaign would continue, etc.

Despite achieving the same goal, the difference between the two procedures, Initial Exchange Offerings and Initial Coin Offerings, have lots of differences. These differences are:

ICO: In case of an ICO or Initial Coin Offering exchange, anyone with some crypto asset can take part and invest. Basically, it is accessible to anyone and everyone.

IEO: But in case of an IEO, only the registered users of exchange can take part in the fundraising. If you absolutely want to take part in an IEO campaign, you need to have an account and funds in that account with that specific crypto exchange platform.

ICO: When it comes to ICO industry, there is no intermediary between the startup and the investor. The investors send the funds directly to the token issuer.

IEO: In case of an IEO, the cryptocurrency exchange work as the regulatory body. They are the third party existing between the startup and the investors. In this case, however, the third party exists to regulate and authenticate only the legit projects and save the investors from scam.

ICO: When it comes to ICOs, you can send the funds directly to the company from the investors.

IEO: In the case of an IEO, the funds the investors invest go through the exchange.

ICO: In case of an ICO, the market centralization is not possible because the fundraisers are being held on separate platforms. And there is no intermediary party in between the startup and the investor.

IEO: IEO market has two types of trends. The organizers want to hold their IEO campaign on the best crypto trading platform that has the largest user base. And the investors want to participate in IEO campaigns held on the most secure exchange platforms that have the best reputation and a large number of tokensails held on it.

Which is how in a few years there is a high chance that most IEOs will be held on a select few exchange platform. This will give those selected exchange platforms too much power and they would start dictating their conditions to the investors and organizers like the central banks and trading markets.

ICO: As for ICOs, there is no need to disclose all information related to the company and the startup to the investor. All the startup needs is a landing site and a whitepaper to start with. This lack of transparency is what gave rise to the ICO fraud in 2017.

IEO: In case of an IEO exchange, on the other hand, it is impossible, because the startup has to disclose all information not only related to the project but also related to the company and its employees. The company needs to go through the due diligence process to be listed on the exchange platform, decreasing the chances of frauds with a higher level of transparency in the process.

During the first IEO campaign, it was noticed that the startup coins tend to sell very fast. This gave rise of criticism among the crypto investors who didn’t have a chance to take part in the tokensale.

ICO: Such a problem was solved with “gas’ wars in case of an ICO. The first buyers in an ICO campaign were entitled to big discounts, so the investors would overestimate the Gas price to become the first buyers.

IEO: But in case of an IEO, this problem is solved by a lottery. This lottery is performed using a randomized transparent system. The distribution of the tickets of participation in the lottery is carried out according to the number of exchange tokens on the user’s deposit in the last 20 days.

Last but not least, there is a major difference between the two methods when it comes to reputation.

ICO: The increased fraudulent activity in the ICO has somewhat diminished the reputation of the process. The unchecked, sketchy startups have succeeded in raising around $1.34 billion through ICO fundings, which is close to being 11% of the entire amount raised by the blockchain industry through ICO.

IEO: The process of IEO is, however, extremely regulated. The diligence process any project needs to go through to get listed on the exchange platform is more than enough to filter out any of the scammy and fraudulent projects.

So, what is the last word in the matter of IEO then?

It is very obvious that when you compare, Initial Exchange Offering is definitely a better method of crypto fundraising than Initial Coin Offering. It is safer, and there is a higher chance of ROI.

But that does not mean that IEO exchange has no flaws at all. The three major downsides of this process are

On top of that, the new tokens that are available right after the IEO campaigns are vulnerable to market manipulation. IEO would only expose the coin to a selected number of investors, (the users of a certain crypto exchange platform) and this can lead to market manipulation.

However, despite all the downsides of IEO, it is still a very new method of crypto crowdfunding and still evolving.

Whether it rises to be the best way of raising funds in the blockchain industry or drowns in frauds and scams like its predecessor, is something we all have to wait and see for ourselves.

We’ve Eliminated the Barriers.

We stand by our work, and you will too.