Unlock Expert Advice with Zero Commitment.

We’ve Eliminated the Barriers.

If you are reading this, it is obvious that you have thought of making an app that eliminates the hassles of the payment industry. But what’s your take on our current payment method? How do you feel about the procedures?

Isn’t it lengthy and time-consuming?

Deep down we all know that this very mode of the transaction has become primitive. Especially when compared with the new p2p payment innovations of the last decade.

In fact, a new p2p payment solution is already on the move and is trending at the same time. Although it is yet to be accepted as “the” official system of payment, the rising popularity of p2p payment solution is gradually shifting the market paradigm to a new direction. So how to create Venmo like app? How are you going to create an app that is going to be “the P2P payment solution” for people? Well, here we are going to answer your question.

Before we start thinking about how to create a money transfer app, we need to know what is a p2p payment app and how do payment apps work.

It is pretty simple. Peer-to-peer money transfer apps are like middlemen, helping users to send money to their friends and family.

These apps are connected to the user’s bank account, credit card or debit card, and users can send money by connecting with their friends and family. The money transfer can take a few minutes to three days, depending on various factors such as distance to bank specifications.

P2P payment app development has also gained serious popularity. So now that we know how p2p apps work, it’s time to find out how to build a mobile payment system.

Here we are going to give you the precise steps of how to develop money transfer app. Take not, cause you’ll need it later.

Before we start the discussion about how to make an app like PayPal, let’s run through the different types of P2P apps, and see how the P2P Payment system actually works.

The type of P2P apps can be divided into two categories,

The crypto apps can be categorized in two ways, and the first one of those is based on vendors or developers.

These are based on who is developing the app. There are bank apps, third-party payment apps, and then p2p payment methods integrated into social media platforms. Let’s take a proper look at this.

Here, you register your details with a third party vendor. This includes your bank account and credit card information. The vendor will use these details to facilitate fund transfers between individuals. The traditional involvement of banks is excluded from this method. You have to download their application in order to carry out your transaction.

Apart from your bank details, your identity would include your email address using which you can send and receive funds from anyone using the application. There are many apps using this method, the most popular one being PayPal. Since you’ll be the third party here, you have to market it really well and keep the performance quality up to the mark. Else the registered user count would be too low, giving your peers the competitive edge.

This method is useful for banks and financial institutions trying to catch up with the digital transaction trend. Here, the corporation launches an app to facilitate all the transactions a bank does, but on an e-platform.

Once again, they’d use your email id for the process. Users who trust their banks over some third party can rely on this p2p payment technique for both security and convenience. They don’t have to install a third-party app. In case you’re an owner of a bank or financial institutions, you can implement this p2p vendor payment method to retain your consumers in this ever-changing digital environment.

Also, the one on the receiving end of any transaction won’t necessarily have to be a customer of that particular bank. This is a feature that gives bank apps an edge over the third-party ones.

It’s hard to imagine someone without a social media presence these days. Millions of users interact frequently over the net. That’s why p2p payment service providers like Facebook, WeChat, etc have come up with a p2p payment method enabling its users to transfer funds while texting. With increasing user base, this p2p payment method is pushing hard to become one of the mainstream money transfer techniques in the market.

In some cases, however, a third party vendor app might partner with a bank/credit card company for a smooth transaction. It is something that falls between the above-mentioned categories. But it is highly recommended that you follow either of the three methods. It would ensure clarity for your consumers and set a fixed direction for you as well.

We all know different kinds of currencies used all around the world, like dollars, pounds, euros, etc. But these are not the only kinds of currency out there.

There is another world of currency out there, the cryptocurrency world. Bitcoins, Ethereum, Litecoin are few of the names among the large community of virtual currencies. And these two different kinds of currencies would definitely require different kinds of P2P apps.

These payment apps are for fiat currency. Fiat currency is a convenient term for physical money. These p2p apps, like Venmo or square cash, make it easy to perform payments for everyday small tasks, like paying for dinner or paying back your friend. Whether it is a third party app or bank app, these p2p apps are made to make small payments directly to a person or a vendor.

Now if you are a frequent user of cryptocurrencies, then you might be wondering if there are any p2p payment apps for cryptocurrency as well? Well, the entire blockchain-based currency system is created with the peer to peer payment method in mind.

And that’s why you can perform all kinds of p2p payments with crypto-wallets. Apps like Breadwallet, Mycelium, Dropbit are excellent examples of P2p cryptocurrency apps, with which you can perform crypto-transaction easily from person to person.

There are also exchange apps. Platforms like Binance, Kucoin, Bitmax are excellent cryptocurrency exchange platforms that help the users to perform P2P trading of cryptocurrencies,

Now let us explore the possible features you can use to make your p2p payment app as profitable as possible. The features should be unique enough to trigger instant conversions. So what features do you need to make apps like cash app?

At the time of any transaction, the user would receive a one time password. He/she needs to validate the password in order to allow the transaction to happen.

Or you can give them a fingerprint system for higher security. As we all know, any digital platform comes with the risk of getting hacked. We need to ensure our information are secure and untampered. We’ll be covering the security part under the blockchain section shortly.

Under the current monetary system, we have to carry a physical wallet wherever we go. The act of carrying it is not much of a burden since we longer have to harbor huge volumes of cash, thanks to ATM card system, but we always have the tendency to misplace it.

With the concept of a digital wallet, it’s simply not possible. Even if you lose the phone, you can always access it from other phones or devices. The information is stored in the cloud and you have the facility to access it with your id and password from anywhere at any given time. You just need to maintain a certain amount in your digital wallet. So if you want to know how to create apps like Venmo, then make sure that you consider this feature.

Use this facility to notify the user every time a payment is initiated or received. The user would be notified about the activity, as well as any changes made to his/her digital wallet.

Also, provide custom alert systems for upcoming bill payment dates. This would be of huge benefit to the users since they’d be reminded of the dates without having them planned. It often becomes really hard to plan schedules amid the hectic weekdays. This is where this particular p2p payment feature will come in handy.

Under the current system, we check our bank statements to verify transaction records.

What if there was an app for that? Indeed, it would be far more convenient to check history without leaving the comfort of our homes. We won’t have to visit the ATMs or bank branches to draw statements. It would reduce both time and money on your user’s end.

Although the intention of this p2p payment idea is to alter the traditional monetary system, still we can always give them the facility to combine the two. You might not realize, but innovating a new idea without hurting the consumer’s belief system is far more productive than that which enforces change onto the public. Let the user base gradually assimilate the idea. It’s new to them after all.

This p2p payment feature will enable them to transfer funds to and from their bank accounts, as well as avail the new cloud-based innovation at the same time. In this way, you’d be able to penetrate the market as well as gain a strong consumer base.

A user can have several queries while carrying out a transaction. Even before conducting a simple purchase, the user may want some questions to be answered. To address this, give them a chatbot facility. One that would have all the questions answered instantly. This will increase user satisfaction, and hence bring in higher conversion rates.

Currency varies across nations and so does currency rates. Plus we also need to convert our money whenever we wish to transact in a foreign land. If you can provide an application facility for this, then people won’t have to rush to currency exchange centers every time they land in some foreign country. Plus they’d be able to view the currency rates against the US dollar without separately searching for it on Google. This will help them to work on their budgets accordingly. It is one of the key features you can include to attract more and more users

Suppose you want to send some written message with the fund you’re transferring. It might be a confidential one, but important for the particular transaction. Whatever it is, it’s not possible in our current model of fund transfer, right? Well, make it happen! Incorporate a p2p payment facility where a user can attach a confidential text message with the fund. This will ensure good communication between the users on both ends.

Cryptocurrency is trending in the financial market right now. You must have heard of digital currencies like Ether, Bitcoin, etc. They are nothing but digital substitutes of existing currencies in the market. Your user might trade in these and would frequently want to transact using the same. Give them a facility where they can use digital currencies instead of traditional legal tenders. In this way, you can add these users to your consumer base, thus expanding it.

Now, for the sake of this point, we are going to assume that you are familiar with the blockchain world. But if you are not, and want to know more about the Blockchain application development world and its designs then make sure you read the importance of UI UX design in Blockchain applications.

For now, all you have to know about blockchain is that it is a public ledger system where all the p2p transaction history gets logged. It is an immutable, and secure way of keeping a transaction history.

Adding this specific ledger feature to your p2p payment app is not only going to make it more feature-rich, but it’ll make it more secure. The immutable digital ledger will keep a track of all the transactions that are taking place, reducing the chances of fraud and theft.

You can’t just work with a p2p payment app builder to develop and launch peer to peer apps just like that. There are some legality and security regulations to go through first.

Every country has its own regulatory laws for p2p apps. Asian sector is at the very forefront with their regulatory standards for payment apps. On the other hand, the US has their own sets of laws when it comes to p2p apps. Without obeying these laws, your app can not be launched in the market.

But here are a few ways you can secure your payment apps for the users.

No one wants to use a payment app that will play Russian roulette with their money and its security. So make sure that your app is secure and to use.

Choosing the right stack depends on the app’s nature (native/web/hybrid). Since yours will be a native app, your developer would use the respective tech stack.

For more details, shoot us your query!

Mainly there are 3 kinds of apps: Native, Web and Hybrid.

Yours being a payment app needs to be native by design. Plus native apps are preferred more across the globe. It would be designed in a native structure for both Android or iOS. Users find it more convenient to navigate through a native application than anything else. It offers a better UI/UX.

Ever thought how does cash app make money? What is the monetization strategy for a p2p payment app?

Behind every successful app, there’s a good revenue model. After all, its profit that boosts an entrepreneur for further development. A good revenue model ensures a good annual profit and a steady flow of capital. Without this, all ideas, efforts and high-end features would be of no use. The capital structure of any app is crucial in gearing its success. It helps an entrepreneur to steer his/her business in the right direction.

There are mainly 2 methods from which you can select any one or go for all of them:

Allow your users to avail the basic features like fund transfers, transaction history, etc. But only allow the premium users to avail high end features like a chatbot, cryptocurrency transactions, text messaging facility, currency rates, and conversion facility, etc.

You can ask banks or financial institutions to display their products on your app page. You have to provide a space for a banner. When the user clicks on it, it will generate revenue. This is called pay per click method. It is a widely used earning technique. You can use it too.

Building a P2P Payment app all by yourself is a tedious task. It requires time and a considerable amount of resources. Proper licensing should be done as well. All these are provided by a developer. But how do you choose the right one? Whom to hire? Freelancer or Professional Agency?

While freelancers are enthusiastic individuals keen on serving with passion, they don’t guarantee long term sustenance and professionalism. Freelancers are often reported to leave in the middle of the development process. They are not bound by the legal norms that tie agencies to servitude.

Hence it is always advised to go for a professional agency. They would charge more than freelancers, but it’s worth the investment. We invest in high-end tools and software in their inventory to deliver cutting edge solutions in the market.

Unlike freelancers, a trusted mobile app development company like us will deliver projects within the stipulated time and budget. Our methodology incorporates agile techniques aligned with the latest market trends and innovations.

Just like any other app market, the pep payment app segment is also full of apps that are competing with each other to get the biggest share of the market. So, when you are developing any kind of app, it is wise to take a measure of the competitors.

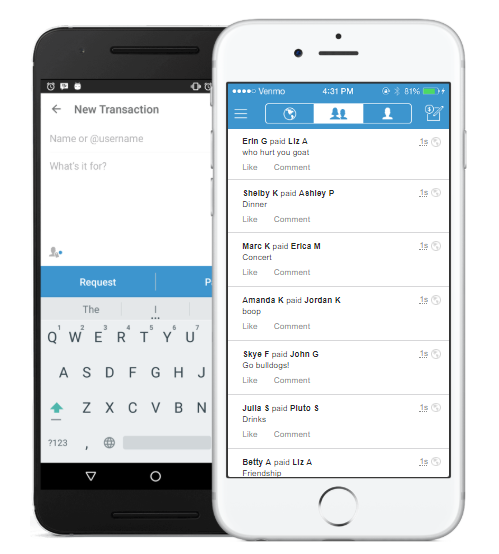

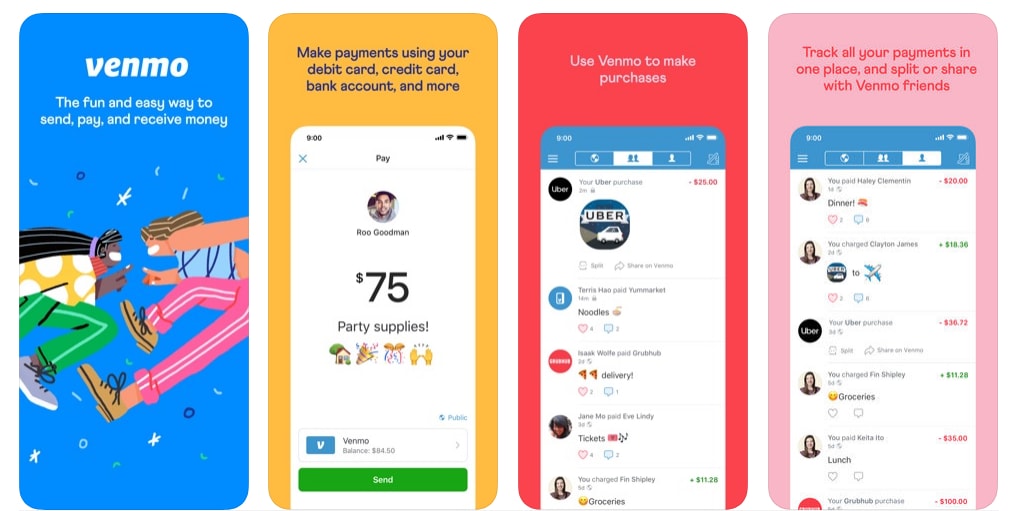

Venmo is probably the most popular app in the p2p payment sector. It’s fun, it’s easy and it is definitely every young user’s favorite way to transact money with.

Venmo comes with a plethora of features that make it one of the market toppers. It is the fastest way of sharing money with friends and family, and not to mention users can also shop by using Venmo Mastercard. On top of that, Venmo takes the security of the users very seriously.

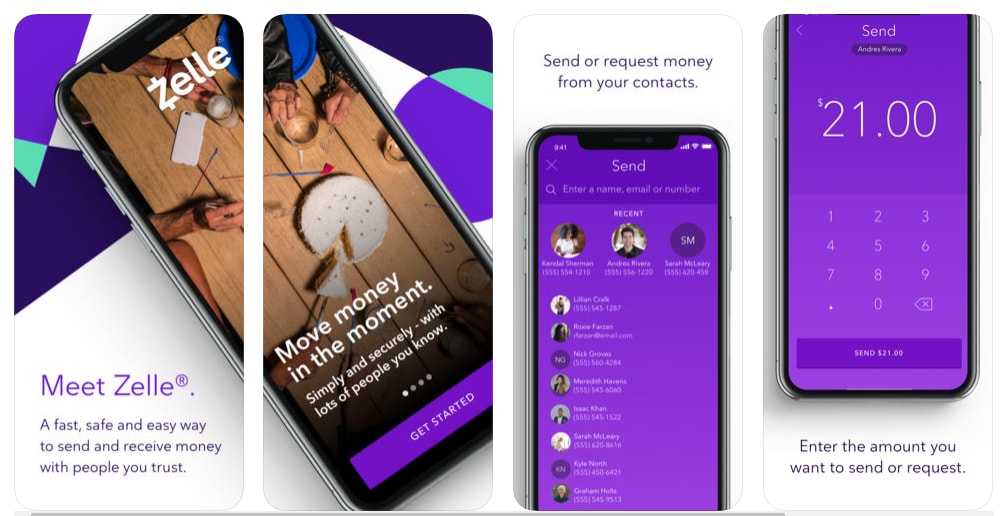

Zelle is another payment app taking the market by storm and many are even saying that it is better than Venmo.

The app has partnered with leading banks and credit card unions in America to deliver the users with the most secure p2p money transaction experience ever. And since it is directly connected to many banks, it is considered to be one of the safest options for a p2p money transaction apps, even though it lacks the two-factor authentication feature.

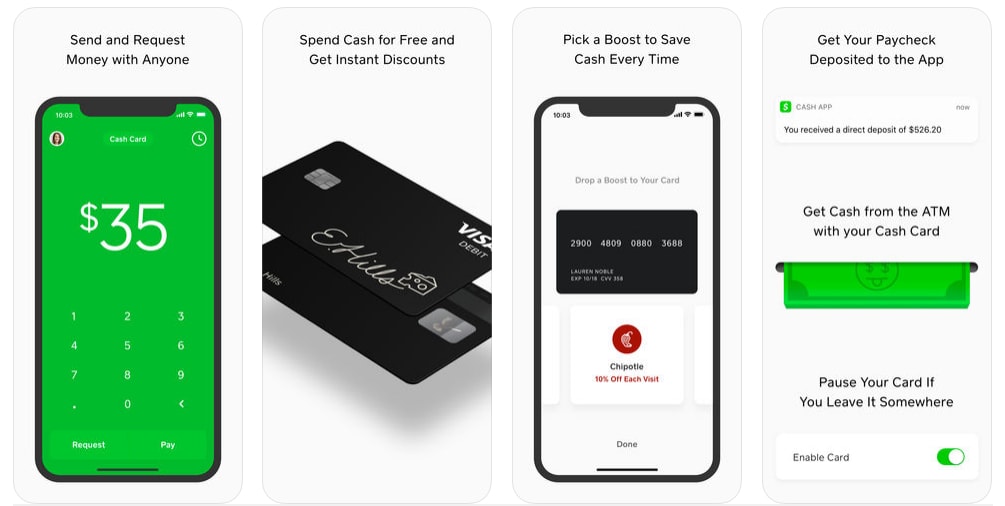

Cash app, previously known as square cash, is another p2p app that is creating quite a buzz in the market. It does similar things, such as sending money in a fast and easy way without any fuss.

But what makes it different is that it also doubles as a cryptocurrency wallet app. As of June 2019, the Cash app has rolled out a feature with which the users can deposit bitcoins from external wallets to their app bitcoin address. So if you want to create a cash app like a payment app, then you should check out their details list of features.

So now that we know p2p payment apps are in fact the newest app trend in the market, you won’t be wrong to go ahead and grab the chance of developing a money transfer app, but you might need some help with that.

At Unified Infotech, we have a team of trained developers, experienced enough to deliver high-end solutions in the market. Their years of hands-on industry exposure guarantees quality service within the desired schedule.

Our team assists in every step and keeps you updated with the process. Have a P2P payment app idea in mind? Feel free to connect with our expert team to get assistance.

We’ve Eliminated the Barriers.

We stand by our work, and you will too.